The vaping industry has grown substantially over the past two decades, becoming a well-established segment of the nicotine market. Vaping products offer adult consumers a significantly less harmful alternative to combustible cigarettes—especially for those seeking to quit smoking or reduce their exposure to harmful substances.

A wide array of vapor products and electronic nicotine delivery systems (ENDS) are available on the market. Open-system devices allow users to refill them with various e-liquids, offering customization and greater control over flavor and strength. Closed-system products, on the other hand, utilize pre-filled, non-refillable cartridges or pods. These devices are simpler to use and have grown increasingly popular, but many of them remain unauthorized for sale in the United States by the Food and Drug Administration (FDA).

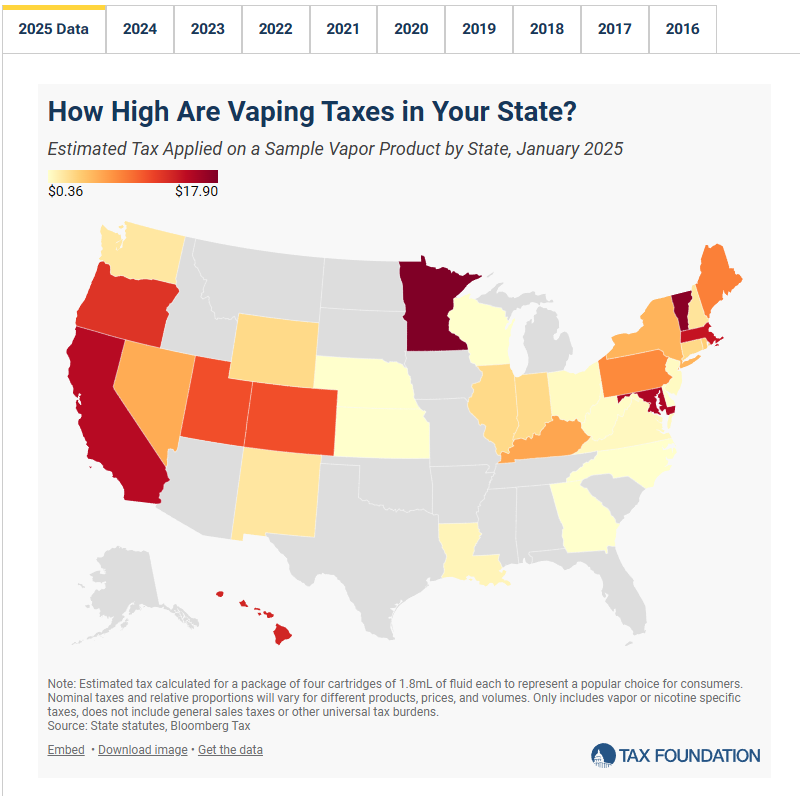

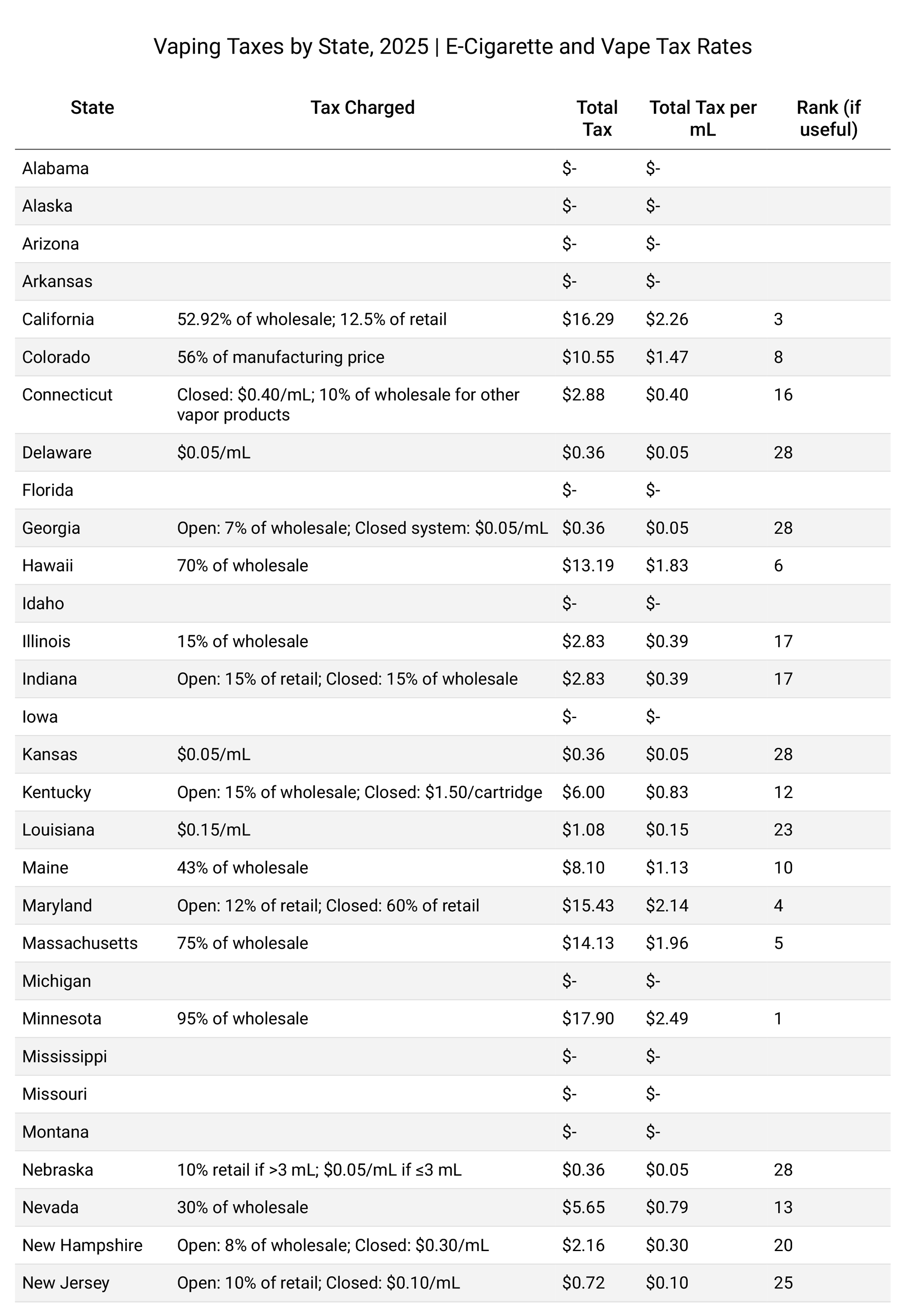

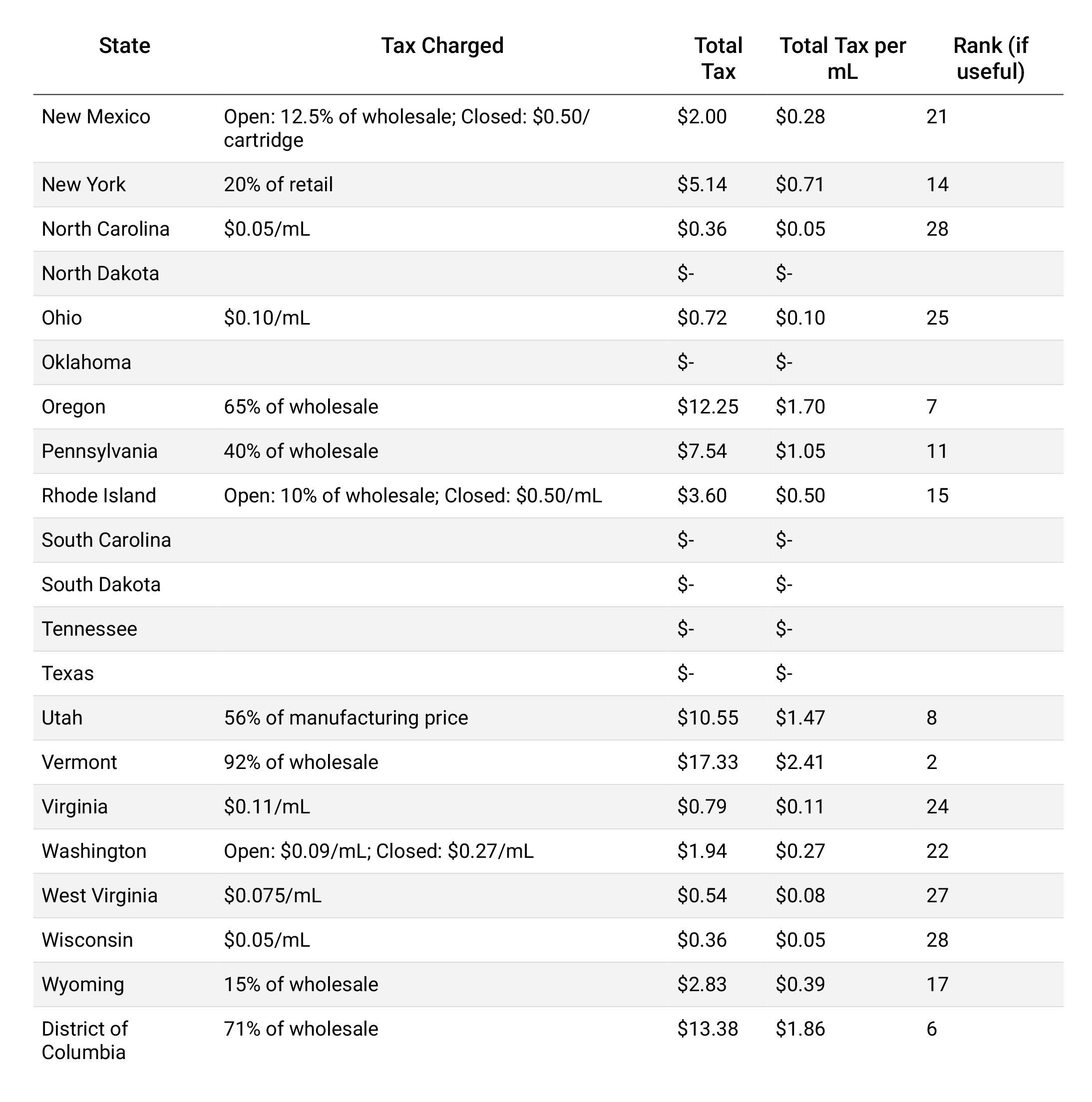

As of January 2025, 33 states and the District of Columbia levy excise taxes on vapor products. Tax structures vary widely across states and can be applied based on manufacturer price, wholesale or retail price (ad valorem), or product volume (specific tax). Some states also use bifurcated systems, taxing open and closed systems differently.

This variation makes it difficult to compare tax burdens across jurisdictions. To address this, the Tax Foundation calculated each state's tax on a sample product: a 4-pack of 1.8 mL closed-system cartridges, with a wholesale price of $18.84, assuming a 5% wholesale markup and a 30% retail markup.

California reduced its wholesale tax rate from 56.32% to 52.92%.

Colorado increased its manufacturing tax from 50% to 56%.

The District of Columbia reduced its wholesale tax from 79% to 71%.

Rhode Island enacted a new tax: 10% of wholesale for open systems and $0.50/mL for closed systems.

Virginia increased its per-milliliter tax from $0.066 to $0.11/mL.

Minnesota imposes the highest overall tax burden—$17.90 per 4-pack, equivalent to $2.49/mL, with a 95% wholesale rate.

Vermont and California follow, with $17.33 and $16.29, respectively.

Delaware, Georgia, Kansas, Nebraska, North Carolina, and Wisconsin have the lowest tax at $0.36, based on a flat $0.05/mL rate.

Maryland applies the highest retail tax rate at 60% on closed systems.

Rhode Island has the highest volume-based rate at $0.50/mL, followed by Connecticut ($0.40/mL) and New Hampshire ($0.30/mL).

Some states, including Florida, Texas, Michigan, and others, do not currently tax vapor products.

Tax policy plays a pivotal role in influencing consumer behavior. High taxes on vaping products, which are demonstrably less harmful than combustible cigarettes, can deter smokers from switching and inadvertently undermine public health efforts. For instance, Minnesota’s 95% wholesale tax has been linked to over 32,000 fewer smokers quitting, compared to states with lower rates.

Leading health authorities, including Public Health England and King’s College London, have concluded that vaping is approximately 95% less harmful than smoking. These findings underscore the importance of harm reduction—the concept that policies should aim to reduce harm rather than eliminate risk, especially when total abstinence is unrealistic.

Sound excise tax design should reflect the relative risk of each nicotine product. Over-taxing vapor products, especially while maintaining lower taxes on traditional cigarettes, is counterproductive. Such policies may not only discourage switching but also drive consumers to illicit markets, where products are unregulated, untaxed, and potentially unsafe.

An optimal regulatory and tax framework would:

Support harm reduction goals

Encourage smokers to transition to safer alternatives

Limit black market growth

Generate sustainable tax revenues

Protect adult consumer choice

Vapor products represent an opportunity to significantly reduce smoking-related deaths. Policies that enable, rather than obstruct, harm reduction could yield substantial public health and economic benefits.